Avis d’Impot is basically income tax in France. All tax residents of France are required to complete a form for the Avis d’Impot which includes reported income and the requirement for the date of submission may change. A general calendar of dates for tax notices is available online as well as by mail.

Understanding your tax return reply form ‘Avis D’Impot’

For the vast majority of income tax notices, the deadline for Payment of the tax balance is September 15 for the previous year’s income.

The form you need to submit will generally need filing by May and this lists the income you receive, and the deduction of allowances – leaving you with a net figure to pay if required.

In 2019 ‘PAS’ – Prélèvement à la source – has been introduced whereby the authorities began to implement a ‘pay as you earn’ system.

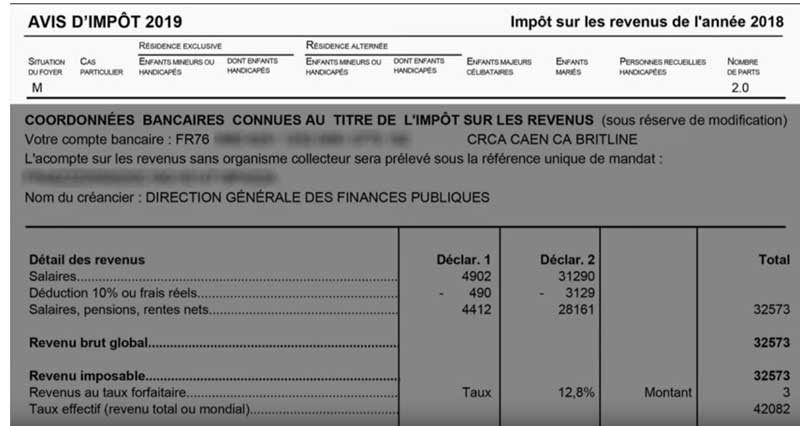

French tax is calculated on a parts system so in this example below, you can see that the ‘nombre de parts’ is 2, meaning 2 adults. If you have children they also have ‘parts’ to contribute which differs according to the number of children. Further allowances are available for those who are disabled or over 65.

A brief explanation is as follows:

- This shows income earned by each individual which may be salary, pension or rental income.

- This corresponds to ‘PFU’ known as flat tax or Prélèvement Forfaitaire Unique which is tax payable on all investment income.

- This is the gross amount of tax before any allowances are input.

- These are the reductions netting down your taxable income.

- Revenue fiscal de reference. This is a measure of the household’s resources and makes it possible to obtain, for example, social benefits or certain tax exemptions for those over 65.

- This shows a person who has a régime micro enterprise where tax is payable quarterly on declarations.

If you think there has been an error made on your tax return you normally have until mid-December to make a correction. Generally, tax experts will tell you to pay the tax owed first and then ask for a correction rather than run the risk of a fine for non-payment. If you have any doubts whatsoever, then you should consult a tax professional.

Video about your Avis d’Impot

You can read more about the Avis d’Impot on the Impots.gouv.fr website (French only).

Jennie Poate is a qualified and authorised financial adviser, working for Beacon Global Wealth Management. She is happy to answer any queries you may have by telephone or email and she and her team would be delighted to help you with any pension or investment queries.

Please note, we are not tax advisors and the above is just a sample tax return for illustration purposes only. We cannot be held responsible for any person who acts upon the information provided in this article.

Jennie can be contacted at: jennie @ bgwealthmanagement.net; Tel: France 0033634119518; www.beaconglobalwealth.com for information and factsheets

The information on this page is intended only as an introduction only and is not designed to offer solutions or advice. Beacon Global Wealth Management can accept no responsibility whatsoever for losses incurred by acting on the information on this page.

The financial advisers trading under Beacon Wealth Management are members of Nexus Global (IFA Network). Nexus Global is a division within Blacktower Financial Management (International) Limited (BFMI). All approved individual members of Nexus Global are Appointed Representatives of BFMI. BFMI is licensed and regulated by the Gibraltar Financial Services Commission and bound by their rules under licence number FSC00805B. The financial advisers trading under Beacon Wealth Management are members of Nexus Global (IFA Network). Nexus Global is a division within Blacktower Financial Management (International) Limited (BFMI). All approved individual members of Nexus Global are Appointed Representatives of BFMI. BFMI is licensed and regulated by the Gibraltar Financial Services Commission and bound by their rules under licence number FSC00805B.